0% interest on intraday trading collateral funding and carry forward interest will only be charged on the funded amount @ 14% pa.

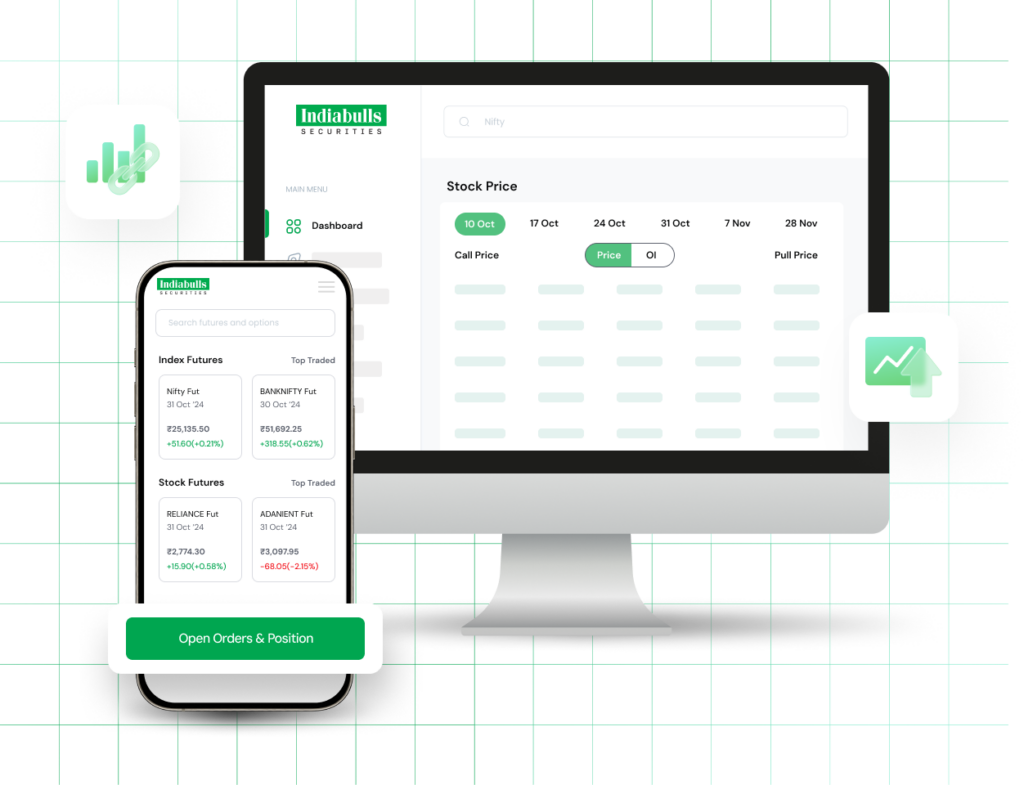

Real-time analysis for open interest and volume for faster execution of your option strategies.

Enhance your options trading experience with premium charts and trending open interest (OI). Using our Insta Option strategy, you can execute bulk orders with a single click.

With our free APIs, you can easily create your trading terminal that supports real-time order execution and management. Benefit from lightning-fast performance, with an order placing speed of 500 orders per minute and a response time of just 150 milliseconds, all through our multi-language agnostic APIs.

Track market trends with real-time, customized charts and key technical indicators to make better trading decisions.

Trade intraday using collateral with no interest charges, reducing your trading costs

Trade intraday using collateral with no interest charges, reducing your trading costs

Trade intraday using collateral with no interest charges, reducing your trading costs

Check your margin costs and start trading smarter. Calculate now!

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

One stop solution for all your investment needs including Stocks, F&O, Mutual Funds, & more. Enjoy our platform’s extensive features and real-time data.

Independently handle all your trades and investments while having access to expert guidance whenever needed.

10

10

20

20

To begin trading FnO with Indiabulls Securities, create a trading account, complete the KYC process, and fund your account. You can then use our trading platform to execute FnO trades.

Margin needs vary according to the contract and market conditions. Indiabulls Securities provides competitive margin rates and clear information on margin requirements while placing trades.

Simply log in to your Indiabulls Securities account, go to the FnO trading section, select your desired contract, and trade utilizing our user-friendly platform.

In options trading, the Greeks consider risk. Delta measures price sensitivity, Gamma records Delta’s rate of change, Theta displays time decay, and Vega evaluates the influence of volatility on option prices.

By purchasing options, such as a protective put or a covered call, you can limit possible losses on your stock investments and provide a hedge against negative market fluctuations. platform.

Margin requirements are the amount of capital required in your account to open and maintain a position in futures or options. This serves as collateral to offset potential losses.

The premium is determined by several factors, including the underlying asset’s price, strike price, time to expiration, volatility, and market demand for the option.

Options are classified as ITM (In The Money), ATM (At The Money), or OTM (Out of The Money) depending on how near the option’s strike price is to the underlying asset’s current market price.

Advanced options strategies include the Bull Call Spread, Bear Put Spread, Iron Condor, Straddle, and Strangle. In volatile or neutral markets, these tactics help to limit risk while maximizing earnings.

An option chain displays all available option contracts for an underlying asset, including strike prices, premiums, and other important information. Analyzing the chain allows you to find prospective trades based on market patterns, implied volatility, and volume.

Download Forms | FAQs | Grievance Redressal | Cookie Policy | Disclaimer | Terms And Conditions | Dhani Rewards Terms and Conditions | Brokerage Terms And Condition | Filing Of Complaints On SCORES – Easy & Quick | Whistleblower Reporting | Advisory – KYC Compliance | Privacy Policy | Filing Of Complaints On SMART ODR Portal | Account Closure Instructions | Exchange Guidelines For Online Account Closure | Depository Guidelines For Online Account Closure | Exchange Holidays | Mandate Management | Dhani Nest Trader

Policies And Codes | Important Guidelines | Investor Awareness Regarding Revised Guidelines On Margin Collection | Advisory For Investors | Investor Charter – Stock Broker | Investor Charter For Depository & Depository Participants | Investor Complaint Data – Stock Broker | Investor Complaint Data – Depository Participant | Segregation And Monitoring Of Collateral At Client Level | Details Of Client Bank Account | Risk Disclosures | Member Detail | Procedure For Opening An Account | Procedure For Filing A Complaint and Finding Out Status | Frequently Asked Questions (FAQs) | Annual Return

Indiabulls Securities Limited (Formerly known as Dhani Stocks Limited / ‘The Company’) is one of India’s leading capital market company, which is registered with SEBI as a Stock Broker (SEBI registration number INZ000036136) and a Depository Participant (SEBI Registration Number IN-DP-423-2019). The Company is in the business of stock broking, commodities trading, depository service, distribution of Mutual Funds/IPOs and other investment and tax planning products. About Us

Indiabulls Securities Limited [Corporate Identification Number for DSL: U74999DL2003PLC122874] SEBI Registration Number: INZ000036136; NSE Membership Number 08756 (Capital Market, Futures & Options and Currency Derivatives Segment); BSE Membership Number: 907 (Capital Market, Futures & Options); MCX Membership Number: 12835; Registered office address: 1/1E, First Floor, East Patel Nagar, New Delhi – 110008. Tel.: 011-41052775, Fax: 011-42137986.

Correspondence office address: Plot no. 108, 5th Floor, IT Park, Udyog Vihar, Phase – I, Gurugram – 122016, Haryana.

The non-broking products/services like Mutual Funds, IPO, etc. are not exchange-traded products/services, and Indiabulls Securities Ltd. is just acting as a distributor of such products/services. All disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism. Read more

*Minimal Brokerage of ₹0.01 per order.

#for first year only.

App ratings are based on the App Store and Play Store as of November 15, 2024.

The securities are quoted as an example and not as a recommendation. The rates & figures quoted are for representational purposes only.