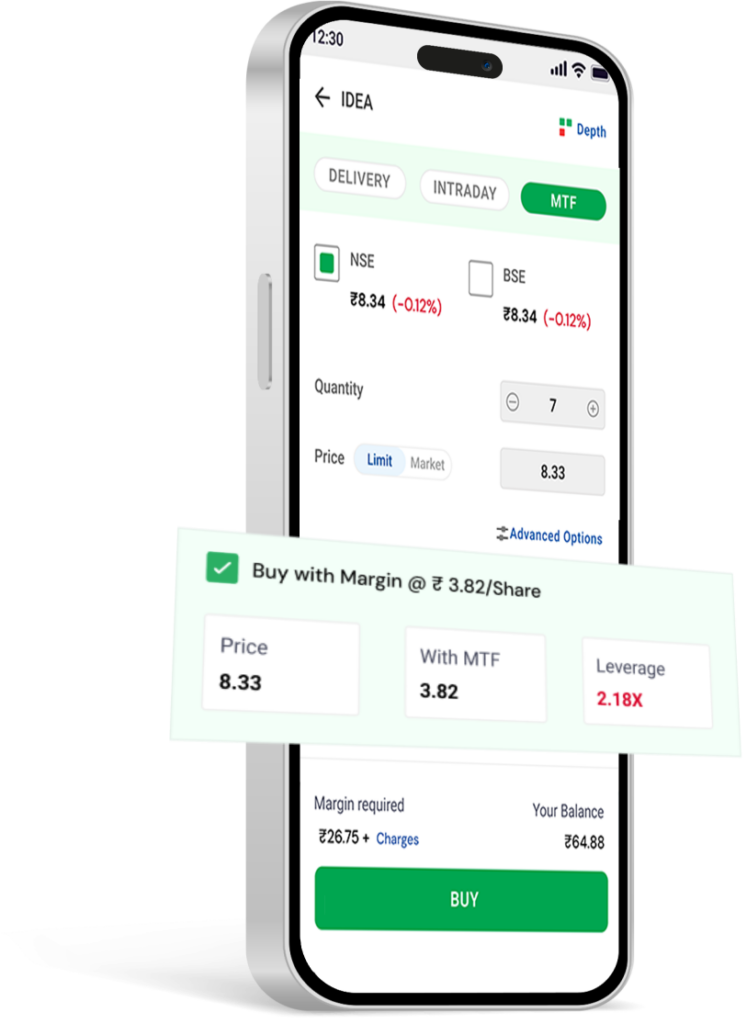

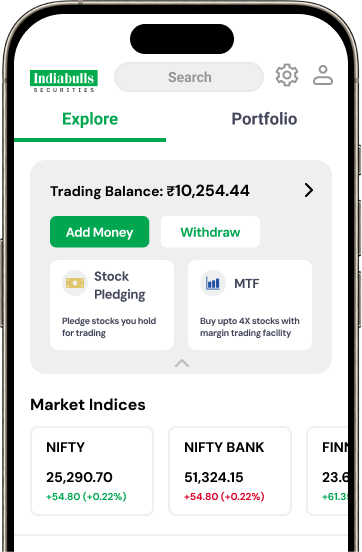

Allows you to borrow funds to increase your trading position. This leverage can amplify potential returns but also increase risk.

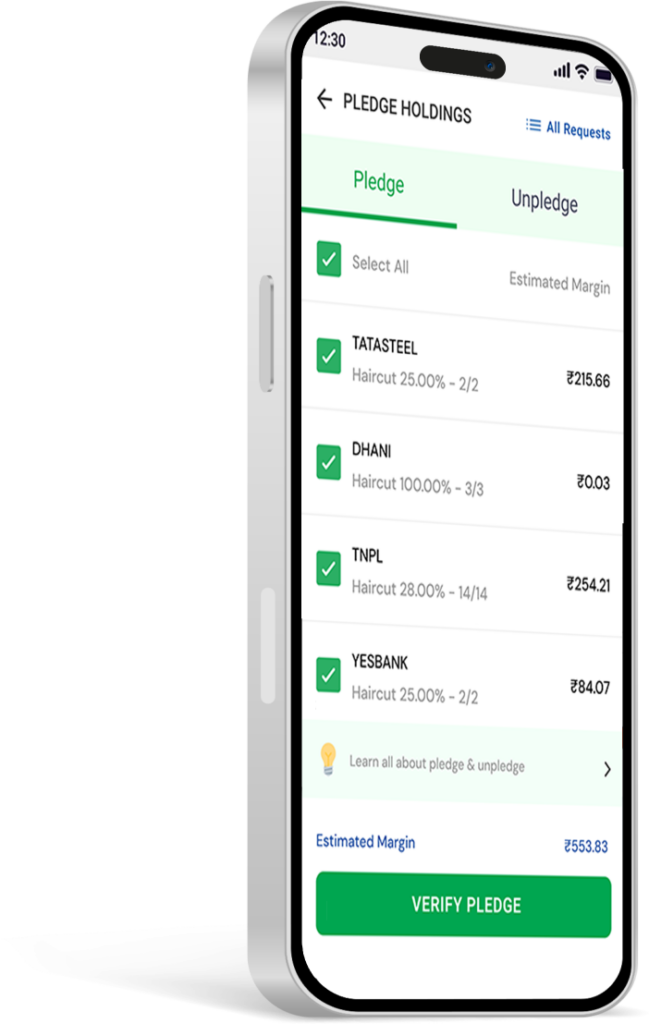

By pledging your stocks as collateral, you can have access to additional funds for trading or investing, maximizing your capital usage.

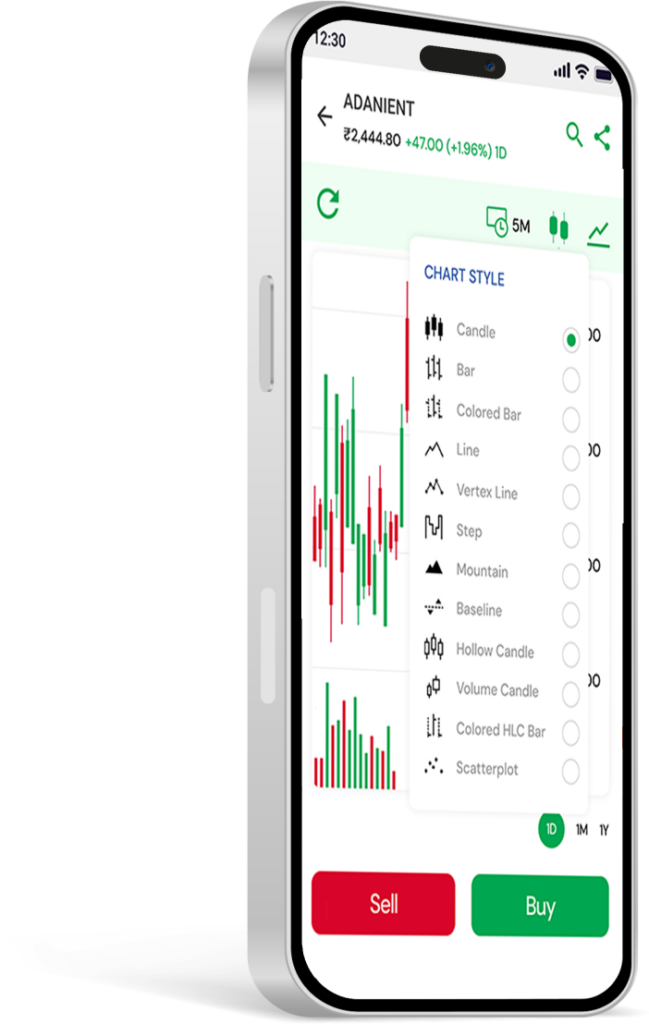

Offers customizable tools for analyzing stock price movements and trends, resulting in better-informed trading decisions.

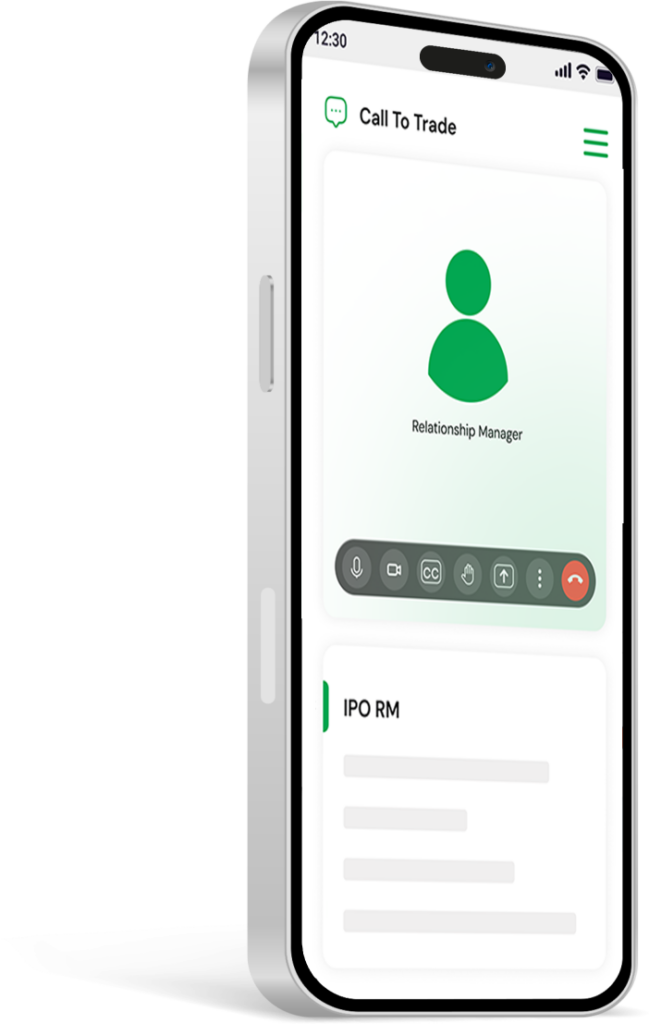

A personal relationship manager assigned to help you with trading strategies and portfolio management and to provide tailored investment advice.

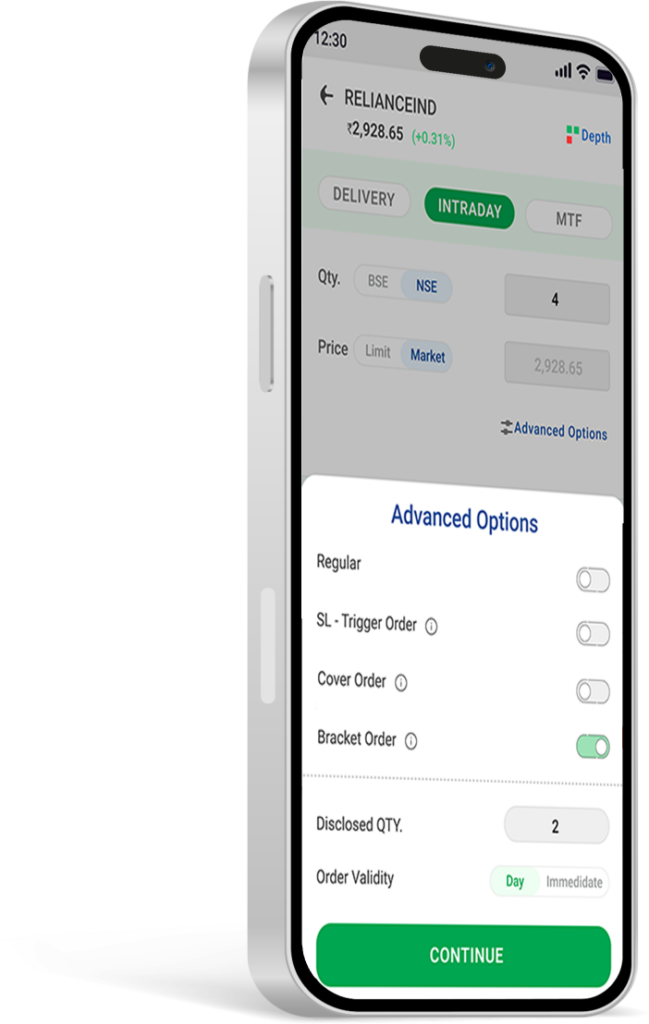

Includes Stop-Loss, Limit Orders, and OCO (One Cancels Other), provide greater control over transactions.

Offers detailed market analysis, stock recommendations, and professional insights to guide decisions.

Know exactly what you’re paying. Calculate your exact brokerage and start building your portfolio today.

10

10

20

20

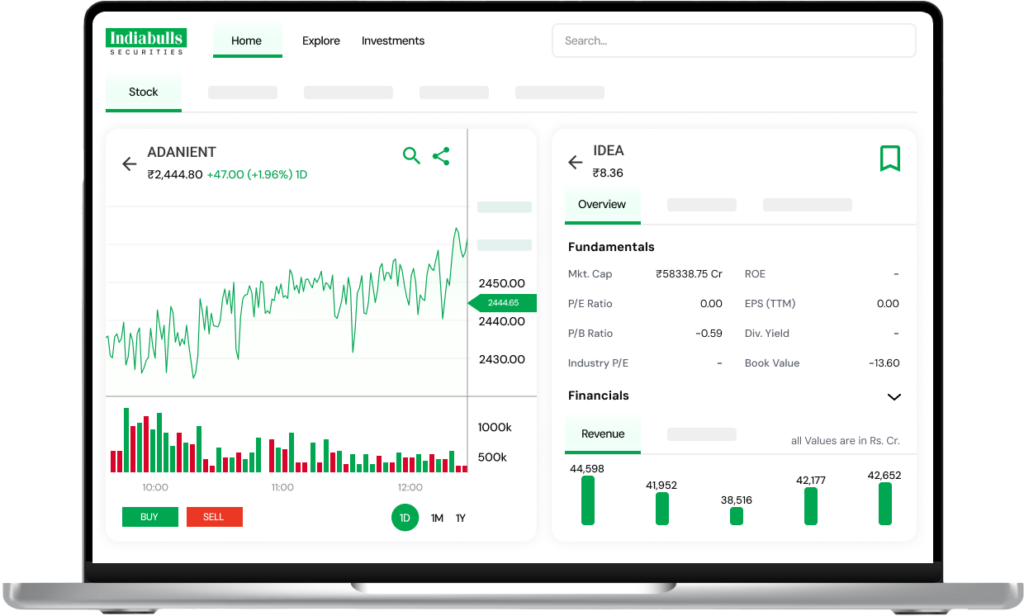

Dive into the fundamentals and financials of stocks and understand key metrics like EPS, P/E ratio, and ROE to evaluate company health and performance.

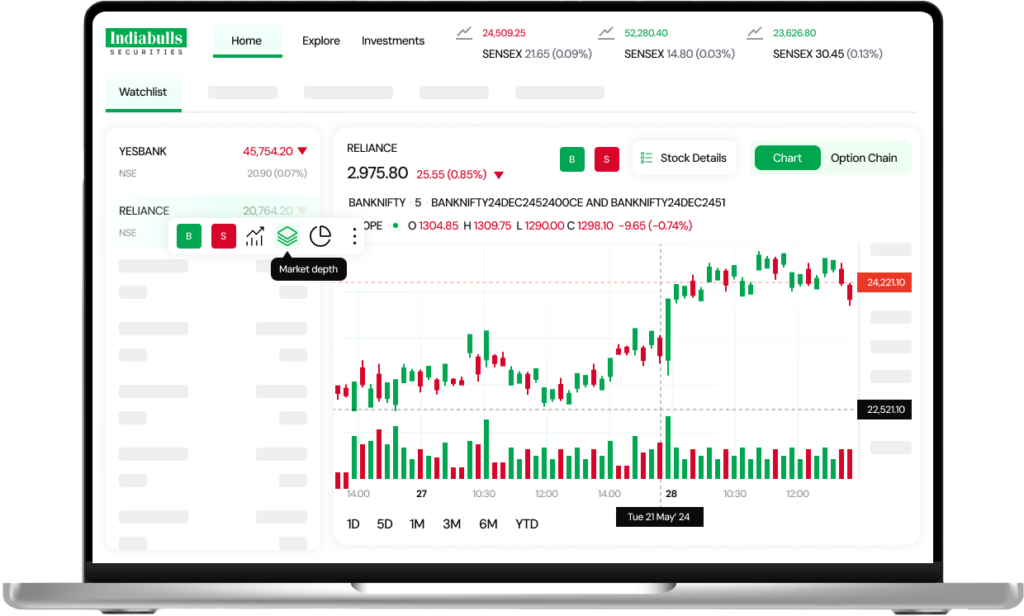

Optimise your trading strategy with our advanced data visualisation tools and charting solutions to analyse and track market movements and make informed decisions.

Stay ahead with insights on stock splits, dividends, rights issues, and more to get a comprehensive view of past and future corporate actions.

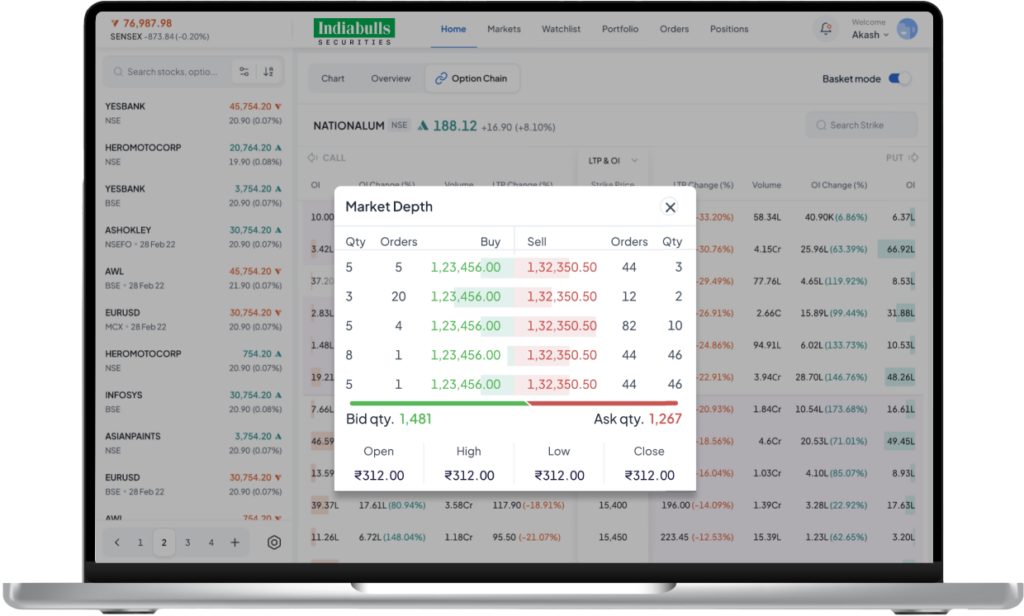

Stay ahead with real-time access to market depth, and read the most accurate bid ask and spread to take action accordingly.

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

Reliance Industries

2,924.00

-8.50 (-0.29%)

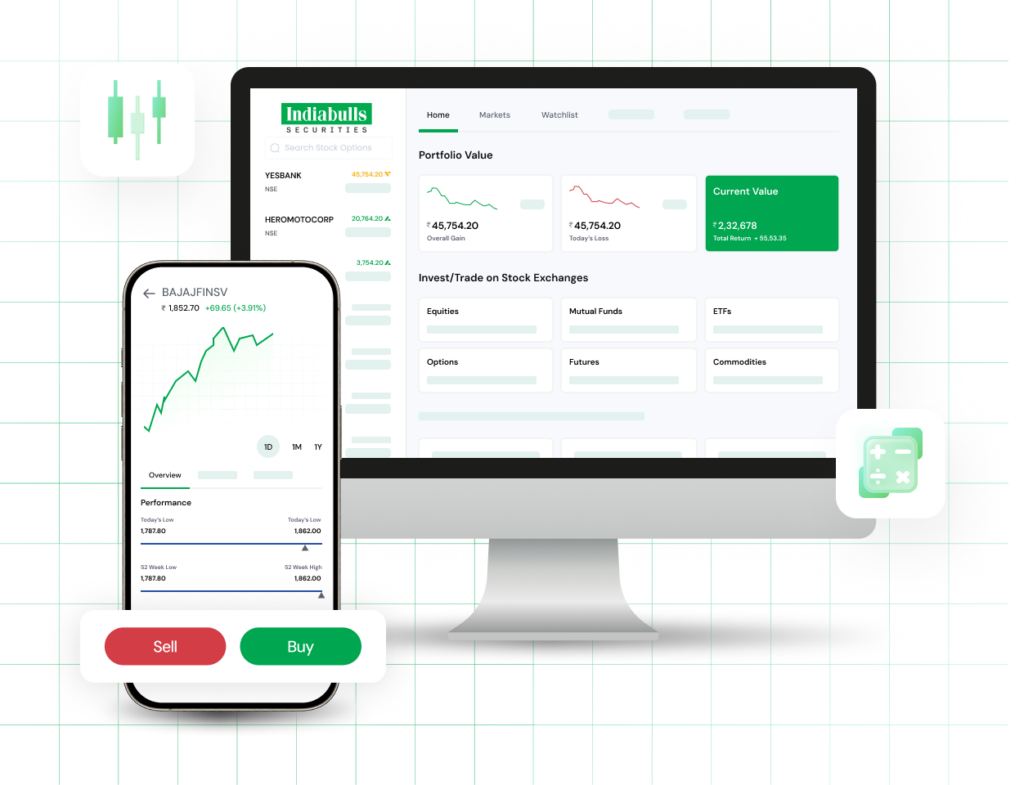

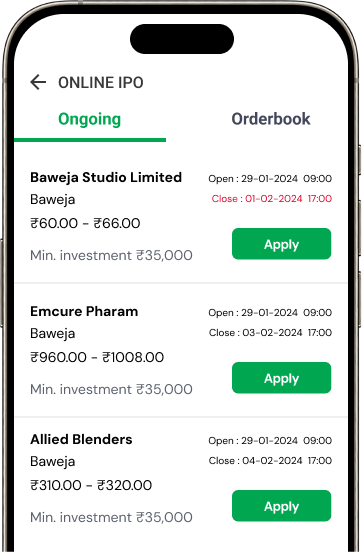

One stop solution for all your investment needs including Stocks, F&O, Mutual Funds, & more. Enjoy our platform’s extensive features and real-time data.

Independently handle all your trades and investments while having access to expert guidance whenever needed.

Buying and selling stocks is easy with Dhani Stocks. Log in to your account, search for the stock you wish to trade, input the amount, and submit your order. Our easy interface allows you to effortlessly track and manage your trades.

Stay up to speed on your assets by accessing performance metrics, historical data, and visual charts.

Dhani Stocks prioritizes transparency. We provide 0% brokerage on delivery trades and fully disclose any expenses for additional services. You will always know precisely what you are paying for, with no hidden costs.

Analyze a stock’s performance using criteria such as earnings per share (EPS), price-to-earnings (P/E) ratio, dividend yield, and past performance.

Beta measures a stock’s volatility compared to the market. A beta greater than one suggests more volatility, whereas a beta less than one indicates decreased volatility. It aids in determining the stock’s risk relative to the wider market.

A stock split increases the number of shares you hold while decreasing the share price accordingly. Your total investment value remains constant, but each share is worth less.

To determine intrinsic value, consider using valuation methods like Discounted Cash Flow (DCF), Dividend Discount Model (DDM), or comparing earnings multiples like the P/E ratio to industry averages.

Mergers and acquisitions can affect stock prices by shifting corporate valuations, market position, and possible synergies. Stock prices can rise or fall depending on investor perception and expected advantages.

Earnings reports offer insight into a company’s financial performance. Significant discrepancies from analyst forecasts can cause dramatic stock price swings, both up and down.

Stay up to speed on your assets by accessing performance metrics, historical data, and visual charts.

Analyze a stock’s performance using criteria such as earnings per share (EPS), price-to-earnings (P/E) ratio, dividend yield, and past performance.

Beta measures a stock’s volatility compared to the market. A beta greater than one suggests more volatility, whereas a beta less than one indicates decreased volatility. It aids in determining the stock’s risk relative to the wider market.

A stock split increases the number of shares you hold while decreasing the share price accordingly. Your total investment value remains constant, but each share is worth less.

To determine intrinsic value, consider using valuation methods like Discounted Cash Flow (DCF), Dividend Discount Model (DDM), or comparing earnings multiples like the P/E ratio to industry averages.

Mergers and acquisitions can affect stock prices by shifting corporate valuations, market position, and possible synergies. Stock prices can rise or fall depending on investor perception and expected advantages.

Earnings reports offer insight into a company’s financial performance. Significant discrepancies from analyst forecasts can cause dramatic stock price swings, both up and down.

Download Forms | FAQs | Grievance Redressal | Cookie Policy | Disclaimer | Terms And Conditions | Dhani Rewards Terms and Conditions | Brokerage Terms And Condition | Filing Of Complaints On SCORES – Easy & Quick | Whistleblower Reporting | Advisory – KYC Compliance | Privacy Policy | Filing Of Complaints On SMART ODR Portal | Account Closure Instructions | Exchange Guidelines For Online Account Closure | Depository Guidelines For Online Account Closure | Exchange Holidays | Mandate Management | Dhani Nest Trader

Policies And Codes | Important Guidelines | Investor Awareness Regarding Revised Guidelines On Margin Collection | Advisory For Investors | Investor Charter – Stock Broker | Investor Charter For Depository & Depository Participants | Investor Complaint Data – Stock Broker | Investor Complaint Data – Depository Participant | Segregation And Monitoring Of Collateral At Client Level | Details Of Client Bank Account | Risk Disclosures | Member Detail | Procedure For Opening An Account | Procedure For Filing A Complaint and Finding Out Status | Frequently Asked Questions (FAQs) | Annual Return

Indiabulls Securities Limited (Formerly known as Dhani Stocks Limited / ‘The Company’) is one of India’s leading capital market company, which is registered with SEBI as a Stock Broker (SEBI registration number INZ000036136) and a Depository Participant (SEBI Registration Number IN-DP-423-2019). The Company is in the business of stock broking, commodities trading, depository service, distribution of Mutual Funds/IPOs and other investment and tax planning products. About Us

Indiabulls Securities Limited [Corporate Identification Number for DSL: U74999DL2003PLC122874] SEBI Registration Number: INZ000036136; NSE Membership Number 08756 (Capital Market, Futures & Options and Currency Derivatives Segment); BSE Membership Number: 907 (Capital Market, Futures & Options); MCX Membership Number: 12835; Registered office address: 1/1E, First Floor, East Patel Nagar, New Delhi – 110008. Tel.: 011-41052775, Fax: 011-42137986.

Correspondence office address: Plot no. 108, 5th Floor, IT Park, Udyog Vihar, Phase – I, Gurugram – 122016, Haryana.

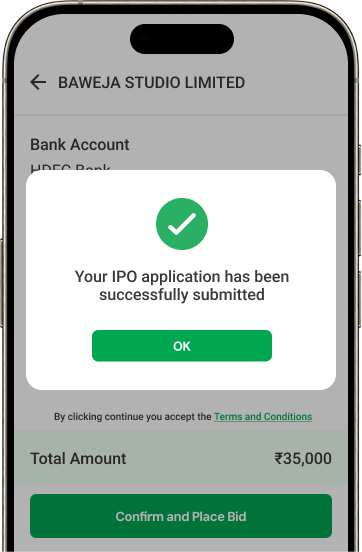

The non-broking products/services like Mutual Funds, IPO, etc. are not exchange-traded products/services, and Indiabulls Securities Ltd. is just acting as a distributor of such products/services. All disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism. Read more

*Minimal Brokerage of ₹0.01 per order.

#for first year only.

App ratings are based on the App Store and Play Store as of November 15, 2024.

The securities are quoted as an example and not as a recommendation. The rates & figures quoted are for representational purposes only.